How to Invest in PrimeXBT

Investing in PrimeXBT offers a unique opportunity to engage with a wide range of financial instruments, including cryptocurrencies, forex, commodities, and indices. This comprehensive guide will provide detailed insights on how to invest in PrimeXBT effectively. We will cover the essential steps, strategies, and best practices that can help both beginners and experienced investors maximize their returns on PrimeXBT. Whether you are new to the platform or looking to enhance your investment strategy, this guide will help you navigate PrimeXBT and make informed investment decisions.

Understanding PrimeXBT

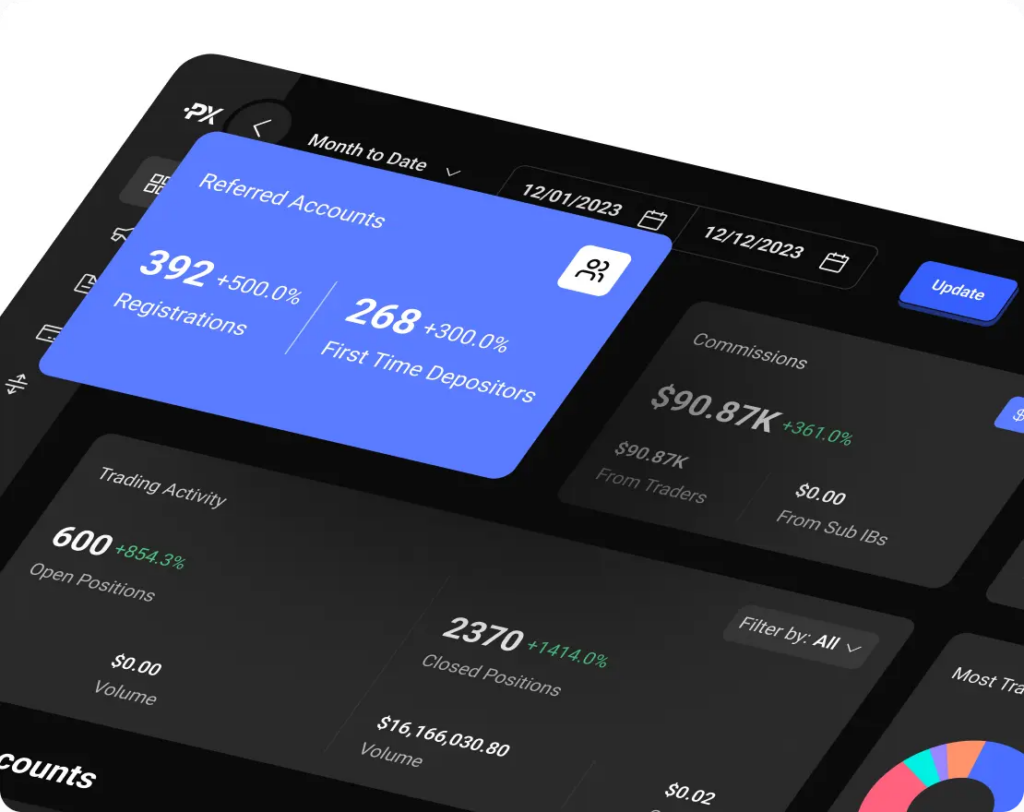

PrimeXBT is a leading trading platform that offers advanced trading features, high liquidity, and competitive fees. It provides a robust infrastructure for trading a variety of financial instruments. In this section, we will explore the key aspects of PrimeXBT, including its features, benefits, and the types of assets available for trading.

PrimeXBT’s user-friendly interface, advanced trading tools, and commitment to security make it an attractive option for investors. By understanding these features, investors can make informed decisions and optimize their investment strategies on PrimeXBT.

- Margin Trading: PrimeXBT allows margin trading, enabling investors to leverage their positions and potentially amplify returns.

- Diverse Asset Classes: Trade cryptocurrencies, forex, commodities, and indices all in one platform.

- Competitive Fees: Benefit from low trading fees and a transparent fee structure.

- Advanced Tools: Utilize advanced charting tools, technical indicators, and various order types to enhance trading strategies.

- Robust Security: PrimeXBT employs stringent security measures to protect user funds and data.

Understanding these features is crucial for leveraging the full potential of PrimeXBT. In the next section, we will guide you through the process of setting up a PrimeXBT account and getting started with investing.

Next, we will explore the steps to set up a PrimeXBT account and begin investing.

Setting Up a PrimeXBT Account

Creating an account on PrimeXBT is the first step towards investing. This section will guide you through the process of setting up your PrimeXBT account, from registration to account verification and funding. By following these steps, you can ensure a smooth and secure start to your investment journey on PrimeXBT.

The account setup process involves providing basic information, completing the KYC (know your customer) verification, and depositing funds into your account. PrimeXBT offers multiple funding options, including cryptocurrencies and fiat currencies, making it convenient for investors to start trading quickly.

- Registration: Visit the PrimeXBT website and click on the “Sign Up” button. Provide your email address, create a password, and agree to the terms and conditions.

- Email Confirmation: Check your email for a confirmation link from PrimeXBT. Click on the link to verify your email address.

- Complete Profile: Log in to your PrimeXBT account and complete your profile by providing additional information, such as your name, date of birth, and address.

- KYC Verification: Submit identification documents and proof of address for KYC verification. This process typically takes a few days.

- Deposit Funds: Deposit funds into your PrimeXBT account using various payment methods, including bank transfers, credit/debit cards, and cryptocurrencies.

Once your account is set up and funded, you can start exploring PrimeXBT’s investment features and tools. In the next section, we will discuss the importance of developing a solid investment strategy for achieving profitability on PrimeXBT.

Next, we will discuss the importance of developing an investment strategy for PrimeXBT.

Developing an Investment Strategy

A well-defined investment strategy is essential for achieving consistent profitability on PrimeXBT. This section will explore various investment strategies that investors can employ, including technical analysis, fundamental analysis, and risk management techniques. By developing and adhering to a robust investment strategy, investors can improve their chances of success and minimize potential losses.

Understanding market trends, analyzing price movements, and employing risk management techniques are critical components of a successful investment strategy. Investors should also consider their risk tolerance, investment goals, and market conditions when developing their strategies.

- Technical Analysis: Use technical indicators and chart patterns to analyze price movements and identify investment opportunities.

- Fundamental Analysis: Evaluate the underlying factors that influence the value of financial instruments, such as economic data, news events, and company performance.

- Risk Management: Implement risk management techniques, such as setting stop-loss orders, position sizing, and diversification, to protect your capital.

- Investment Plan: Develop an investment plan that outlines your investment goals, risk tolerance, and strategy for entering and exiting positions.

- Continuous Improvement: Continuously review and refine your investment strategy based on market conditions and performance metrics.

By incorporating these elements into your investment strategy, you can enhance your investment performance and achieve consistent profitability on PrimeXBT. In the next section, we will discuss the various asset classes available on PrimeXBT and how to choose the right ones for your strategy.

Next, we will explore the asset classes available on PrimeXBT.

Choosing the Right Asset Classes

PrimeXBT offers a wide range of asset classes, including cryptocurrencies, forex, commodities, and indices. Choosing the right asset classes is crucial for aligning your investment strategy with market opportunities. This section will provide an overview of the available asset classes on PrimeXBT and offer guidance on selecting the most suitable ones for your investment strategy.

Each asset class has its own characteristics, including volatility, liquidity, and market dynamics. Understanding these factors will help you make informed decisions and optimize your investment strategy.

- Cryptocurrencies: Invest in popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. Cryptocurrencies are known for their high volatility and potential for significant price movements.

- Forex: Invest in major, minor, and exotic currency pairs in the forex market. Forex trading offers high liquidity and leverage opportunities.

- Commodities: Invest in commodities such as gold, silver, oil, and natural gas. Commodity trading provides diversification opportunities and can be influenced by global economic factors.

- Indices: Invest in global stock indices such as the S&P 500, NASDAQ, FTSE 100, and DAX. Index trading allows you to speculate on the overall performance of a market or sector.

- Leveraged Tokens: Invest in leveraged tokens that offer exposure to multiple underlying assets with leverage. These instruments can amplify potential returns and provide opportunities for diversified investment strategies.

By understanding the characteristics of each asset class and how they align with your investment strategy, you can make informed decisions and optimize your investment performance on PrimeXBT. In the next section, we will discuss the importance of risk management and how to implement effective risk management techniques.

Next, we will discuss the importance of risk management and how to implement effective risk management techniques.

Implementing Effective Risk Management

Effective risk management is essential for protecting your capital and achieving long-term profitability on PrimeXBT. This section will explore various risk management techniques that investors can employ to mitigate potential losses and manage their risk exposure. By implementing these techniques, investors can enhance their investment performance and minimize the impact of adverse market movements.

Risk management involves identifying potential risks, assessing their impact, and implementing strategies to mitigate them. Investors should also consider their risk tolerance and investment goals when developing their risk management plans.

- Stop-Loss Orders: Set stop-loss orders to automatically close positions at predetermined levels, limiting potential losses.

- Position Sizing: Determine the appropriate position size for each investment based on your risk tolerance and account balance.

- Diversification: Diversify your investment portfolio by investing in multiple asset classes to spread risk.

- Leverage Management: Use leverage responsibly and avoid over-leveraging, which can amplify potential losses.

- Risk-Reward Ratio: Evaluate the risk-reward ratio of each investment to ensure that potential returns justify the risk taken.

By incorporating these risk management techniques into your investment strategy, you can protect your capital and improve your chances of long-term profitability on PrimeXBT. In the next section, we will discuss the importance of staying informed and how to keep up with market trends and news.

Next, we will discuss the importance of staying informed and how to keep up with market trends and news.

Staying Informed and Keeping Up with Market Trends

Staying informed about market trends and news is crucial for making informed investment decisions on PrimeXBT. This section will explore various ways to stay updated on market developments, including news sources, economic indicators, and market analysis tools. By staying informed, investors can anticipate market movements and adjust their investment strategies accordingly.

Market trends and news can have a significant impact on the value of asset classes. Understanding these factors and their potential influence on the markets can help investors make better-informed decisions and optimize their investment performance.

- News Sources: Follow reputable news sources and financial publications to stay updated on global economic events, market developments, and industry news.

- Economic Indicators: Monitor key economic indicators, such as GDP, inflation, employment data, and interest rates, to assess the overall health of the economy and its potential impact on the markets.

- Market Analysis Tools: Use market analysis tools, such as technical indicators, chart patterns, and sentiment analysis, to identify investment opportunities and trends.

- Social Media: Follow influential investors, analysts, and financial experts on social media platforms to gain insights and stay updated on market trends.

- PrimeXBT Resources: Utilize PrimeXBT’s educational resources, market analysis, and news updates to stay informed about market developments and investment opportunities.

By staying informed and keeping up with market trends, investors can make better-informed decisions and optimize their investment strategies on PrimeXBT. In the next section, we will discuss the importance of continuous learning and how to improve your investment skills over time.

Next, we will discuss the importance of continuous learning and how to improve your investment skills over time.

The Importance of Continuous Learning

Continuous learning is essential for improving your investment skills and achieving long-term success on PrimeXBT. This section will explore various ways to enhance your investment knowledge and skills, including educational resources, investment courses, and practice accounts. By continuously learning and adapting to market conditions, investors can stay ahead of the curve and improve their investment performance.

The financial markets are constantly evolving, and staying updated on the latest trends, strategies, and technologies is crucial for maintaining a competitive edge. Investors should invest time and effort in learning and refining their investment skills to achieve consistent profitability.

- Educational Resources: Utilize PrimeXBT’s educational resources, including articles, videos, webinars, and tutorials, to enhance your investment knowledge.

- Investment Courses: Enroll in investment courses and workshops to learn advanced investment strategies, risk management techniques, and market analysis methods.

- Practice Accounts: Use practice accounts to test your investment strategies and gain experience without risking real money.

- Investment Books: Read investment books written by experienced investors and financial experts to gain insights into successful investment strategies and market dynamics.

- Networking: Connect with other investors and financial experts to share knowledge, discuss investment ideas, and gain insights into market trends and strategies.

By investing in continuous learning and self-improvement, investors can enhance their investment skills and achieve long-term success on PrimeXBT. In the next section, we will summarize the key points discussed in this article and provide practical tips for investing in PrimeXBT to get profit.

Next, we will summarize the key points discussed in this article and provide practical tips for investing in PrimeXBT to get profit.

Summary of How to Invest in PrimeXBT

| Aspect | Description | Importance |

|---|---|---|

| Understanding PrimeXBT | Key features, benefits, and asset classes available on PrimeXBT | Helps investors make informed decisions and optimize investment strategies |

| Account Setup | Steps to create and verify a PrimeXBT account and deposit funds | Ensures a smooth and secure start to the investment journey |

| Investment Strategy | Developing a solid investment strategy using technical and fundamental analysis | Enhances investment performance and profitability |

| Asset Classes | Choosing the right asset classes based on market opportunities and strategy | Aligns investment strategy with market dynamics |

| Risk Management | Implementing effective risk management techniques to protect capital | Minimizes potential losses and ensures long-term profitability |

| Staying Informed | Keeping up with market trends and news to make informed investment decisions | Optimizes investment strategy and performance |

| Continuous Learning | Enhancing investment skills and knowledge through educational resources and practice | Improves investment performance and adaptability |

This table provides a quick reference to the key aspects of investing in PrimeXBT to get profit. Understanding these aspects is crucial for navigating PrimeXBT effectively and optimizing your investment strategy.